Just when the industry thought mortgage interest rates could not get any lower, they dropped further for the fifth consecutive week to unexpected lows.

Just when the industry thought mortgage interest rates could not get any lower, they dropped further for the fifth consecutive week to unexpected lows.

This might seem to provide existing homeowners with a perfect chance to refinance; however, the data suggests that they are not taking advantage of this opportunity.

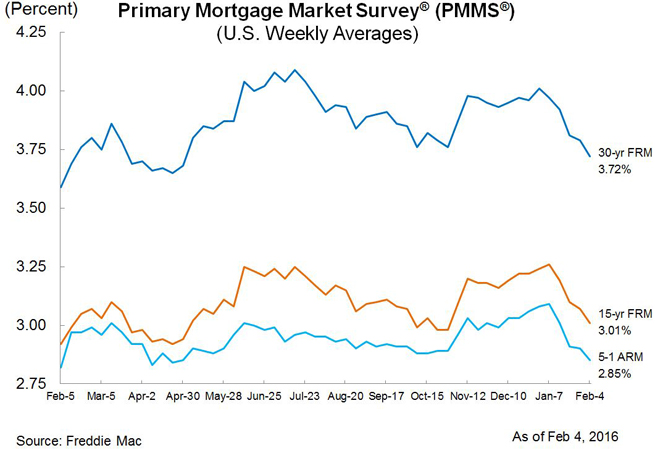

Freddie Mac's Primary Mortgage Market Survey (PMMS) showed that mortgage rates deceased "amid ongoing market volatility" and troubled Treasury yields. The report showed that the 30-year fixed mortgage rate is at its lowest point since April 30, 2015 when it averaged 3.68 percent.

For the week ending February 4, 2016, the 30-year fixed-rate mortgage (FRM) averaged 3.72 percent with an average 0.6 point, according to the survey. Last week it averaged 3.79 percent and a year ago at this time, the 30-year FRM averaged 3.59 percent.

Freddie Mac said that the 15-year FRM this week averaged 3.01 percent with an average 0.5 point, down from 3.07 percent last week. One year ago, the 15-year FRM averaged 2.92 percent.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.85 percent this week with an average 0.4 point, down from last week when it averaged 2.90 percent, the report noted. A year ago, the 5-year ARM averaged 2.82 percent.

"These declines are not what the market anticipated when the Fed raised the Federal funds rate in December," said Sean Becketti, Chief Economist at Freddie Mac. "For now, though, sub-4-percent mortgage rates are providing a longer-than-expected opportunity for mortgage borrowers to refinance."

"These declines are not what the market anticipated when the Fed raised the Federal funds rate in December," said Sean Becketti, Chief Economist at Freddie Mac. "For now, though, sub-4-percent mortgage rates are providing a longer-than-expected opportunity for mortgage borrowers to refinance."

Becketti continued, "Market volatility—and the associated flight to quality—continued unabated this week. The yield on the 10-year Treasury dropped another 15 basis points, and the 30-year mortgage rate fell 7 basis points as well, to 3.72 percent. Both the Treasury yield and the mortgage rate now are in the neighborhood of early-2015 lows."

Although mortgage interest rates continue remain at historical lows, however, potential buyers and refinancers are steering clear of the housing market.

For the week ending January 29, 2016, mortgage applications decreased 2.6 percent from one week earlier, according to the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey.

Matthew Pointon, Property Economist at Capital Economics, noted that the low interest rates "might seem counterintuitive given that the Fed hiked interest rates in December. But the flight to safety triggered by the turmoil in the oil and equity markets has pushed down Treasury yields and therefore mortgage rates. And although we think rates will increase this year, a strong labor market and easing in lending standards will ensure applications for home purchase see further gains."

DSNews The homepage of the servicing industry

DSNews The homepage of the servicing industry