Although mortgage interest rates continue to remain at historical lows, the benefits of this current environment are not being taken advantage of by borrowers due to one pressing factor in the market: surging home price increases.

Although mortgage interest rates continue to remain at historical lows, the benefits of this current environment are not being taken advantage of by borrowers due to one pressing factor in the market: surging home price increases.

Mortgage interest rates have fallen by approximately 35 basis points since the start of 2016, according to Black Knight's latest Mortgage Monitor report. But borrowers are not able to fully reap the benefits from the drop in rates because home prices continue to rise.

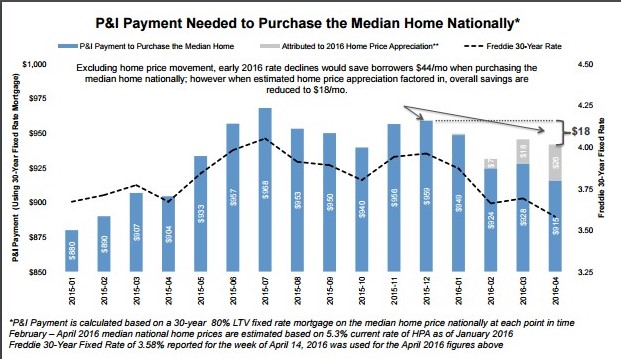

The report looked at how low rates impact home affordability by calculating principal and interest payments based on a fixed-rate mortgage with a 30-year term and 80 percent loan-to-value (LTV) ratio and examining how much per month it would cost a borrower to purchase the median-priced home at the national and state levels.

Black Knight Data & Analytics SVP Ben Graboske explained, "All else being equal, interest rate declines would save borrowers significant money on such a purchase, but as rising home prices are muting—and in some areas, completely cancelling out—the positive impact declining rates would have on home affordability."

Black Knight Data & Analytics SVP Ben Graboske explained, "All else being equal, interest rate declines would save borrowers significant money on such a purchase, but as rising home prices are muting—and in some areas, completely cancelling out—the positive impact declining rates would have on home affordability."

According to Black Knight, borrowers would save approximately $44 a month when purchasing the median-priced home nationally without rapid home price movement in the equation. After factoring in home price appreciation (HPA) at 5.3 percent as of February, those monthly savings decline to $18 per month. However, if rates hadn’t dropped over the past four months, it would cost an additional $28 per month to buy the median-priced home compared to December 2015.

Another impact of falling interest rates is the uptick in the refinanceable population, the report stated. Black Knight estimates this population has grown by 2.3 million from February 2016 to April 2016, bringing the total to 7.5 million borrowers. This is the highest amount since 2013.

The company estimates that about 40 percent of these refinance candidates’ mortgages are from the downturn of the market from 2009 to 2011, which suggesting "perhaps a lack of awareness of sufficient equity to qualify for a refinance," the report said.

DSNews The homepage of the servicing industry

DSNews The homepage of the servicing industry