A recent poll conducted within the United States by Harris Poll on behalf of Trulia found that Republicans and Democrats have contrasting opinions on how they foresee the evolution of the housing market after the election in November. Though issues connected to the housing market have not been discussed at the depth that they were in the previous presidential election cycle during this primary season, both Hillary Clinton and Donald Trump hold varied stances on what housing policy should look like post-election.

A recent poll conducted within the United States by Harris Poll on behalf of Trulia found that Republicans and Democrats have contrasting opinions on how they foresee the evolution of the housing market after the election in November. Though issues connected to the housing market have not been discussed at the depth that they were in the previous presidential election cycle during this primary season, both Hillary Clinton and Donald Trump hold varied stances on what housing policy should look like post-election.

In the limited moments that Clinton has shared her thoughts on what she would do with the housing market if she were to be elected, she stated that $25 billion of her proposed $125 billion Economic Revitalization Initiative would be targeted towards facilitating homeownership among households that have been traditionally underserved. Trump doesn’t want to fund government programs. He wants to eliminate them by implementing his plan to do away with the U.S. Department of Housing and Urban Development (HUD).

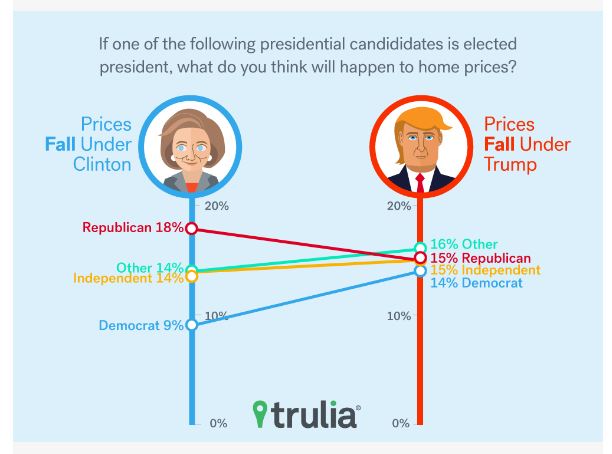

The poll was conducted among 2,034 U.S. adults ages 18 and older and found that Republicans, Democrats, and Independents held varied opinions when asked what they thought would happen to home prices if Clinton or Trump were elected president. If Clinton were to be elected, the democrats polled felt that housing prices would likely rise instead of fall as did the republicans polled. The same was true for Trump. Both republicans and democrats agreed that with Trump as president, housing prices would be more likely to rise as opposed to fall.

The variance in opinion stemmed from which of the candidates each respective party felt would be more likely to raise or lower the housing prices. Republicans showed that they believed the housing prices would be more likely to rise during Clinton’s presidency over Trump’s. For democrats, the data showed more believed that the prices would more likely rise during Trump’s presidency than Clinton’s. In addition to these findings, The Harris Poll found that Americans gave the edge to Trump when it came to who they trusted for a higher-priced housing market.

The variance in opinion stemmed from which of the candidates each respective party felt would be more likely to raise or lower the housing prices. Republicans showed that they believed the housing prices would be more likely to rise during Clinton’s presidency over Trump’s. For democrats, the data showed more believed that the prices would more likely rise during Trump’s presidency than Clinton’s. In addition to these findings, The Harris Poll found that Americans gave the edge to Trump when it came to who they trusted for a higher-priced housing market.

These results would seemingly contradict a recent Zillow survey of over 100 economists and real estate experts who thought that Clinton would have the biggest positive net effect on the housing market. But according to the David Weidner of Trulia the Zillow survey did not conclude whether the positive effect would take into account home prices. It was concluded though that both candidates performed better during the primaries in counties that had risen only minimally from the deepest part of the recession during the second quarter of 2009.

Despite the fact that conversation on the housing market and homeownership has been minimal this election season, Ralph McLaughlin, chief economist for Trulia, said that voters shouldn’t be surprised. “Eight years ago, housing and the economy were the main talking points of Obama and Romney because millions of homeowners were going through foreclosure and the economy was in shambles. Today, the housing market and US economy look much healthier, and as such, candidates have turned their attention to more popular issues such as immigration, gun control, and national security.”

Click here to view the complete report.

DSNews The homepage of the servicing industry

DSNews The homepage of the servicing industry