A little more than half of Americans think it is too difficult to buy a home, especially for non-whites, and they don’t trust banks will help them achieve the American Dream, according to a new poll conducted by New York-based consulting firm Douglas E. Schoen.

A little more than half of Americans think it is too difficult to buy a home, especially for non-whites, and they don’t trust banks will help them achieve the American Dream, according to a new poll conducted by New York-based consulting firm Douglas E. Schoen.

Schoen’s latest report, which polled 1,000 potential voters for this November's presidential election, highlights a broad unrest in the perception of the American housing market, where would-be buyers distrust banks and feel like the system is rigged. According to the numbers, 53 percent of Americans surveyed said a home was too difficult to buy. Broken further, 69 percent of “all people of color” said they couldn’t buy a home. The largest single group feeling left out of the picture was Hispanic respondents, 78 percent of whom feel that homeownership is out of the picture for them.

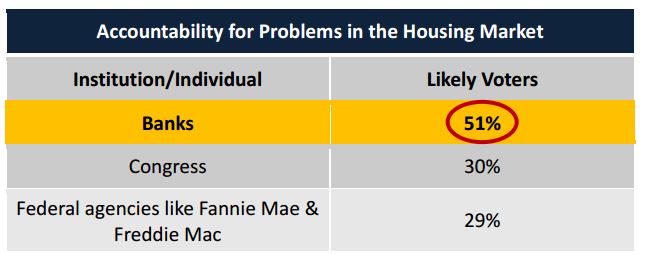

Forty-one percent of respondents agreed with the statement, “Banks don't want to provide mortgages to people like me.” Fifty-one percent blame banks for the lack of access to home ownership, while about 30 percent blame Congress and the GSEs. At the same time, 45 percent of those surveyed said it is up to banks to fix the problem. Less than 35 percent said it should be up to governments or the GSEs.

Fannie Mae and Freddie Mac, in fact, were in slight favor for respondents. According to Schoen, 55 percent of those surveyed had a favorable view of Fannie Mae and Freddie Mac, while 37 percent held an unfavorable view. Seventy percent said they would like to see Congress and the federal government do something to make mortgages more widely available. Interestingly enough, reports have surfaced this week that a draft of the Republican platform calls for the elimination of Fannie Mae and Freddie Mac while scaling back the government’s role in the housing market and implementing tougher underwriting standards for mortgage loans.

and Freddie Mac, in fact, were in slight favor for respondents. According to Schoen, 55 percent of those surveyed had a favorable view of Fannie Mae and Freddie Mac, while 37 percent held an unfavorable view. Seventy percent said they would like to see Congress and the federal government do something to make mortgages more widely available. Interestingly enough, reports have surfaced this week that a draft of the Republican platform calls for the elimination of Fannie Mae and Freddie Mac while scaling back the government’s role in the housing market and implementing tougher underwriting standards for mortgage loans.

When asked about the net worth sweep of Fannie Mae and Freddie Mac (the federal policy that diverts all GSE profits to the government’s revenue stream) in the Schoen survey, 47 percent of likely voters said the sweep “is a violation of shareholder rights, and takes funds that could be used to increase the availability of mortgages,” Schoen reported. “Further, black voters are the most likely to consider the net worth sweep part of a rigged system.”

According to Schoen, 52 of black voters said the sweep is unfair to Fannie Mae’s and Freddie Mac’s shareholders; and 71 percent of black voters support shareholder rights over government interests, the highest of any group, the report stated.

Despite the obvious disillusionment in Schoen’s findings, voters still believe that homeownership is both a good investment with financial benefits. In fact, 58 percent of those surveyed said so, while 57 percent said owning a home is still a hefty piece of the emotional promise of owning a home.

Click here to view Schoen's complete survey.

DSNews The homepage of the servicing industry

DSNews The homepage of the servicing industry