By Terri Cravens

The last several years have been painful for many of the third-party service providers to the mortgage loan industry. The OCC Bulletin 2013-29, CFPB Bulletin 2012-03, and Federal Consent Orders represent only a few of the significant regulatory impacts on these service providers and the mortgage industry. With all of the oversight scrutiny, there has been progress made.

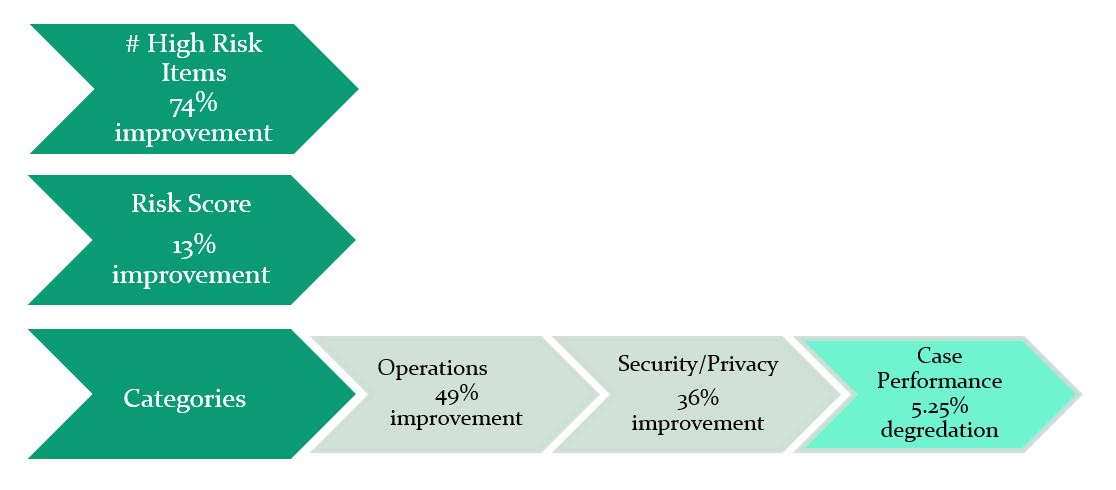

Overall, across all vendor types, we have seen a 74 percent improvement in the number of high risk items identified in operational audits conducted. This results in a 13 percent improvement in risk score of the vending group. Audits conducted are presented in three categories: Operations and Management, Security and Privacy and Case Management. In these three categories, we have seen a 49 percent improvement in the category of Operations and Management, Security and Privacy brings a 36 percent improvement and Case Management reflects a 5.25 percent degredation in performance. Since case management and performance carries the highest weight in the risk scoring, any degredation in the case performance has a higher impact on the overall risk score.

Most of the loan servicing vendor work is fairly low margin business so it could appear that improvements found in the areas of operations, management, security and privacy may be at the expense of case performance, which may not be the best result for the industry and its consumer base. At this time, our observation is that the third party service providers are in much better position with regards to how policies and procedures are documented, they have established documented financial controls, capacity management, and they have improvements in the controls that exist to protect consumer information and business continuity.

It is very important that in this era of ever-increasing scrutiny that while we are ensuring we have solid documented controls in order to meet the regulatory requirements put forth, we have to make sure that the quality and performance of the actual work product remains at a high level.

DSNews The homepage of the servicing industry

DSNews The homepage of the servicing industry